Enemies with benefits

hating on PBMs brings people together

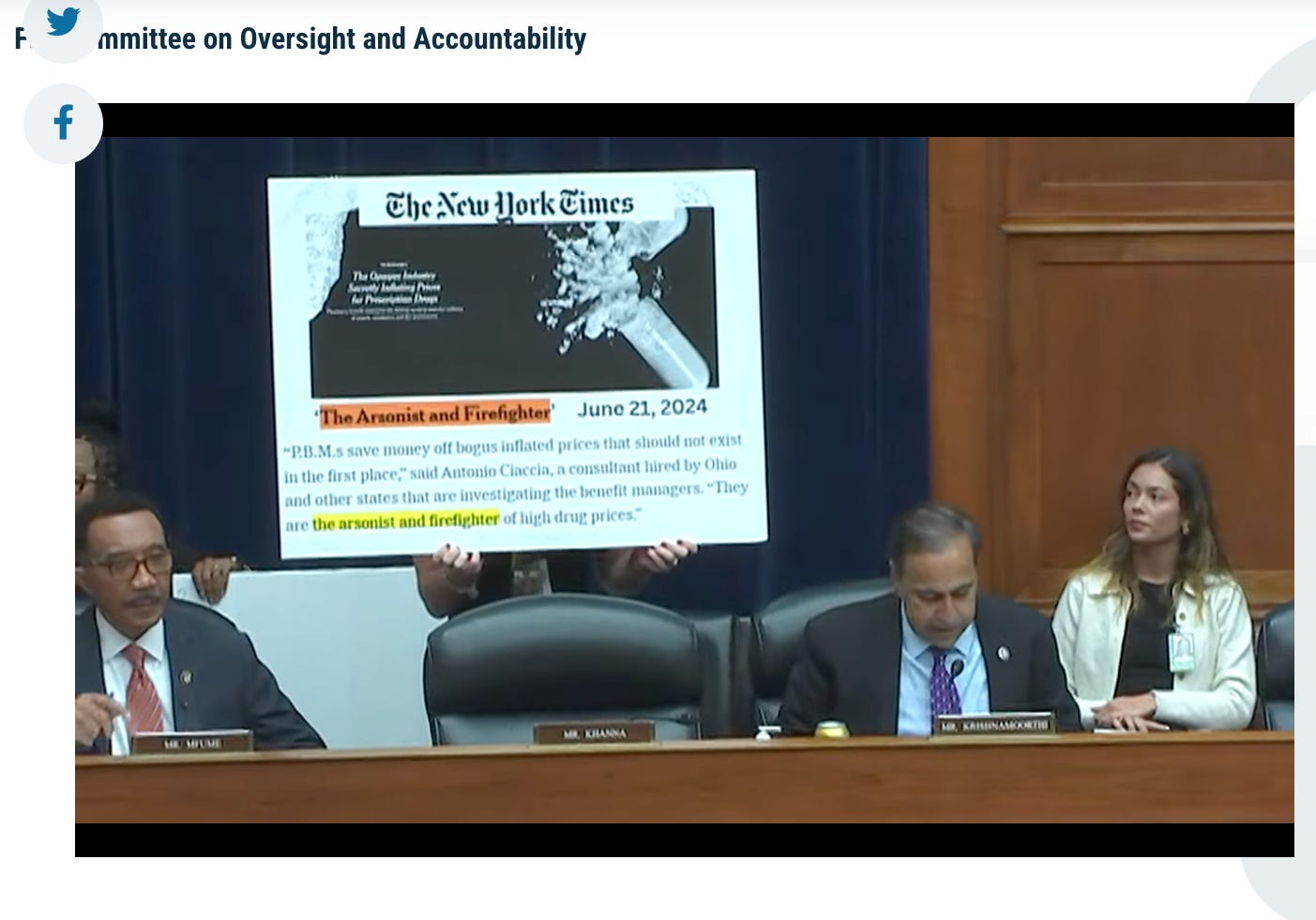

Pharmacy benefit managers (PBMs) can’t catch a break these days, and for good reason. Everyone hates them. After a two-year investigation into their pricing tactics, the FTC plans to sue the three largest PBMs— CVS Caremark, Express Scripts, and OptumRx. The FTC found they’ve engaged in anti-competitive practices that have increased patient costs. It’s an oligopoly, where three PBMs control 80% of the market. An Office of Inspector General for the Office of Personnel Management inquiry found that Express Scripts overcharged U.S. postal workers (federal employees) by $45 million between 2016 and 2021. Further, the House Committee on Oversight and Accountability* held a hearing with the largest PBMs (CVS Caremark, Express Scripts, and OptumRx) as witnesses yesterday. I listened in, so you don’t have to. Their investigation found that PBMs prioritize profits over patients, inflate drug prices, harm community pharmacies, and negatively impact patient care.

Back up. What is a PBM? Walk with me, I’ll keep things high-level. A pharma company sets a list price for a drug (patients don’t usually pay this because of discounts, formularies, manufacturer coupons, etc.) and sells to distributors/wholesalers at a discount. Drugs then go from distributors to pharmacies to patients. We’ll focus on insured patients since this is about PBMs. An insured patient pays their co-pay, and the pharmacy bills their insurance. Enter the PBM. PBMs lend a helping hand to everyone, or have their hands in many cookie jars, depending on who you ask. PBMs work with insurance companies, government agencies, big employers, and unions. Their role? Lowering drug costs for their clients by negotiating with pharma companies. Payers work with PBMs to decide which drugs to cover and how much to charge. Drug companies offer PBMs rebates to get their drugs placed higher on formularies (AKA list of covered drugs tiered by preference). PBMs may keep part of the rebate (imagine an iPad screen tip here) and pass the rest to insurers or employers. This is just one of the reasons pharma companies raise drug list prices.

What’s in it for the pharma companies? Higher rebates translate into better formulary placement for their drugs, which yields more sales since patients often choose the most affordable option.

Higher rebates get their drug placed higher on their drug formulary, which is where drug companies want to be. Think of a formulary like a payer’s IN/OUT list with financial implications rather than lost clout if you’re in the “OUT.” The lower the tier placement, the higher the patient co-pay.

For example, my dermatologist prescribed Finacea, and my insurer charged a higher co-pay for the brand versus the generic (azelaic acid). I chose the generic because it had no co-pay. Later, my employer changed benefit managers, and the new payer placed the branded drug higher on the formulary, allowing me to get it with zero co-pay. I switched! And for what it’s worth, I preferred the branded drug.

What does this mean for patients? Their co-pays are based on the list price, not the actual price for insurers (list price minus rebates/discounts). This sssuuuuuuucks for patients, because of a practice known as a PBM clawback. Let’s say your co-pay is higher than the actual drug price. PBMs will “claw back” the difference. Patients overpay for prescription drugs while PBMs profit.

Now, back to the hearing. Things got heated, as the three execs held steadfast in their position that they have lowered drug costs and dodged key questions on topics like DIR fees (clawbacks) that are harming independent pharmacies, utilization management that delayed patient care, and siphoning patients to PBM-owned pharmacies. At some point, a frustrated Bay Area Congressman was like, “yo did your lawyer draft this statement?” (not in those words, exactly). I’m sure a lawyer did. Later, a Maryland Congressman called the PBM execs “anti-American.” Under oath, the execs said they had good relationships with pharmacists, to which the Committee Chair countered that many pharmacists texted him in real-time to call bullshit on that statement. A Massachusetts rep reclaimed her time to say “I wish you were sorry, you should be.” Never a dull moment in healthcare.

What’s the policy angle? Evidence shows that PBMs drive up costs, limit access, don’t pass savings on to patients, and suffocate independent pharmacies. Sometimes the PBM and the insurer are the same company (e.g., UnitedHealthcare + Optum, Cigna + ExpressScripts). We have a window of opportunity to reform PBMs in the US. The issue has bipartisan support and buy-in from the healthcare industry. We can bully our politicians to build on this momentum to pass laws to increase transparency and hold PBMs accountable. This looks like ensuring drug cost savings reach patients, regulating PBM-insurer mergers, and empowering physicians and patients to choose the treatment that’s fit for purpose.

Until next time,

xxsem

*The House Committee on Oversight and Accountability serves as a legislative branch checks and balances committee for the federal gov/fed agencies. It also holds policy hearings to expose bad actors in our system. Sometimes, the bad actors are big business. They’re pretty powerful. Earlier this week, they interrogated the US Secret Service Director about the attempted Trump assassination, after which she resigned.